bear trap stock term

Learn More About Long Term Investment Stocks. What is Bear Trap.

Bear Trap Explained For Beginners Warrior Trading

A centralized market is a system where orders are routed to a clearinghouse and buyers and sellers transact with the.

. Ad Invest to Achieve Your Goals. Support Level Bear Trap. Bear traps on stocks are usually set in the same circumstances as those described above.

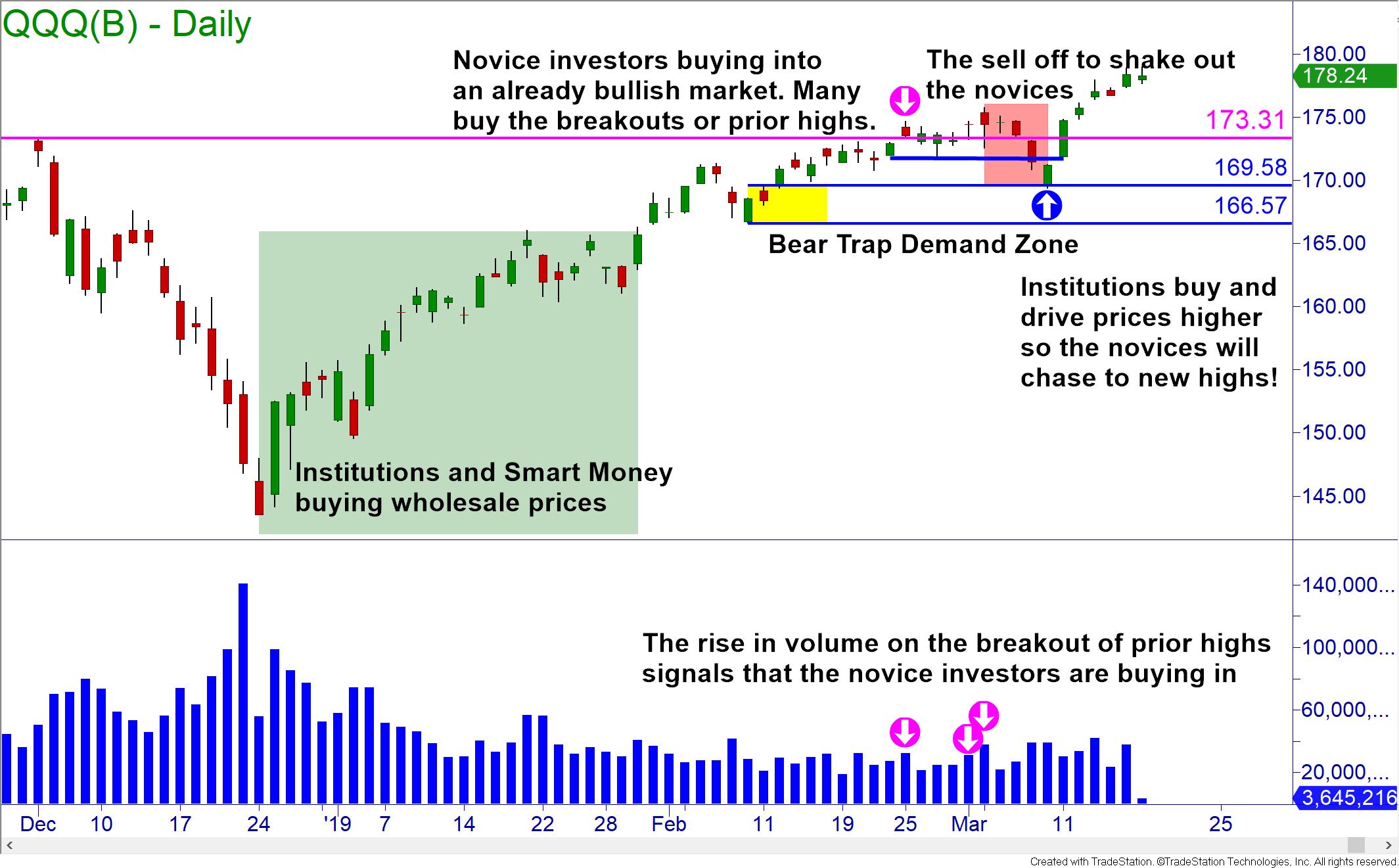

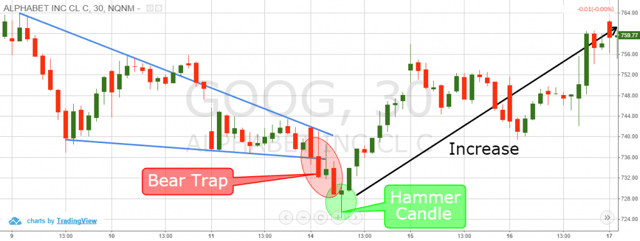

Bull traps act the same way as bear traps but in the opposite direction. Short-term rebounds are common at the start of a persistent down market. A good example of a bear trap can be found on the chart below.

Seeking capital preservation and a higher rate of current income. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller. It may also be referred to as a suckers rally bull trap or dead cat bounce.

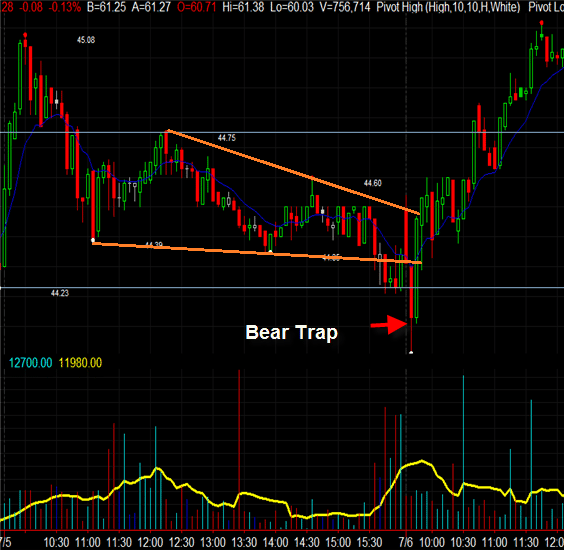

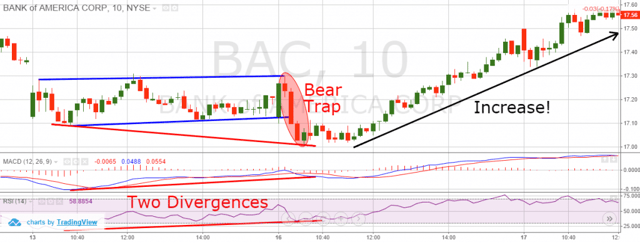

Bear traps could easily be hedged simply by putting stop loss orders on your trades. Hence a false reversal of a declining price trend can be described as the trap. A bull trap is a false signal referring to a declining trend in a stock index or other security that reverses after a convincing rally and breaks a.

Overview and Examples What Is a Centralized Market. This type of false indication is basically a trap where traders tend to get fooled and fall for it. A false signal which indicates that the rising trend of a stock or index has reversed when in fact i.

Beware the Bear Trap Disguised as a Stock Rally. Bear market rallies can be hard to identify while they are happening and can prompt experts to disagree about whether the gains are the start of a recovery or merely a temporary. A bull trap denotes the opposite of this phenomenon in which the reversal of a declining trend is falsely signaled.

A bear trap occurs when the stock that had been trending upward has a sudden price reversal and starts dropping but the decline is temporary and it quickly reverses course again. Stock Surge Is a Bear-Market Trap With Curve Inverted BofA Warns. Essentially the bear trap is designed to encourage investors to buy at a higher price with the anticipation that during the.

Bear Trap is a term that indicates trading situations when a certain stock s price is going downward for a long period of time but suddenly reflects a misleading upward sloping that results in a trap for the short seller. An accumulation of shares being sold short by bears trying to drive down the price of a stock. A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices.

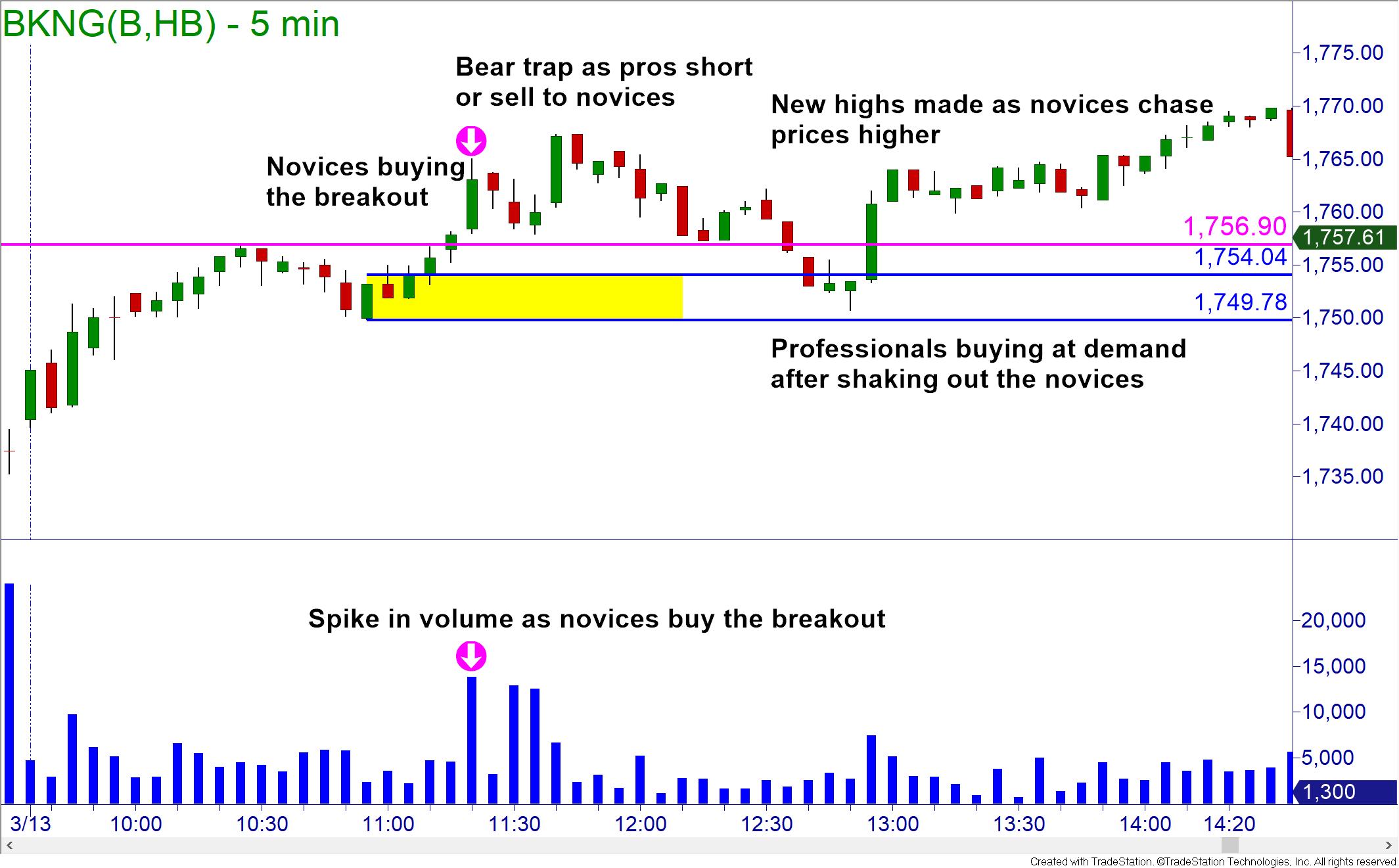

Recommend investors sell out-of-the-money calls to hedge against both downturns as well as any potential short-term run-ups. Rising stock prices cause losses for bearish investors who are now trapped Typically betting against a stock requires short-selling margin trading or derivatives. Now that you know what the professionals are looking for to set the bear trap and how they trade them you.

A bear trap denotes a technical pattern that occurs when the performance of a stock index or other financial instrument incorrectly signals a reversal of a rising price trend. Find Out What Services a Dedicated Financial Advisor Offers. Ad Putnam Ultra Short Duration Income fund is a short-term investment-grade portfolio.

Bear traps spring as brokers initiate margin calls against investors. A Bear Trap is a technical pattern that occurs when the performance of a stock or an index incorrectly signals a reversal of a rising price trend. Diversify your holdings beyond public markets by accessing private markets on Yieldstreet.

Short-term rebounds are common at the start of a persistent down market. A bear market rally is the term for a temporary increase in stock market prices that occurs during a bear market. A bear trap can prompt a market participant to expect a decline in the value of a financial.

Bloomberg Opinion -- There are many ways to lose money in down markets and buying fleeting rebounds is among the best. This pair had formed a support level at around 125 as it retraced lower and then bounced higher to 128 from there. The opposite equivalent of bear traps are the bull traps.

Bear traps can result in major losses for short-sellers meaning those who bet against a stock by selling borrowed shares when they expect the price to drop. Diversify across markets property types and riskreturn profiles. Ad Retail investors can now access private investments traditionally dominated by hedge funds.

The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given security that will be followed by a long term upswing in the price. Spotting bear traps help us avoid them. A bear trap stock is a downward share price that lures investors to sell short Centralized Market Definition.

Based on the anticipation of price movements which do not occur by bear traps investors can be tempted. Ad We vet thousands of real estate projects across the country bringing you the very best. Bear traps occur when investors bet on a stocks price to fall but it rises instead.

Beware the Bear Trap Disguised as a Stock Rally. The Nasdaq Composite Index boomeranged 10 last week from its March 14 low safety-trade gold posted its worst week since June 2021 and money poured into speculative exchange. As we can see GBPUSD is trading on a bullish trend on the daily chart.

When the performance of an index stock or other financial instrument incorrectly signals a reversal of a rising price trend a technical pattern that occurs this is known as a bear trap. But it returned from down there and pierced the support level. Markets rarely make v-shaped recoveries yet we.

What Is A Bear Trap On The Stock Market

The Great Bear Trap Bull Trap Seeking Alpha

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The Bear Trap Everything You Ve Ever Wanted To Know About It

What Is A Bear Trap On The Stock Market

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap Seeking Alpha

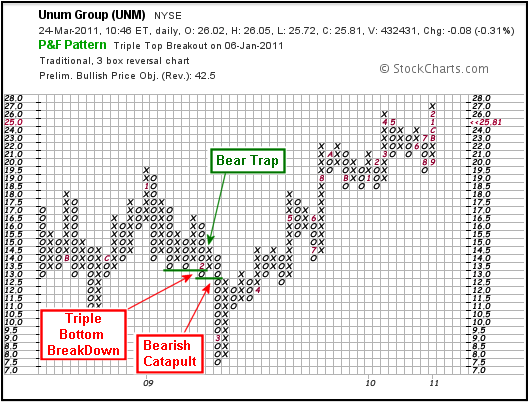

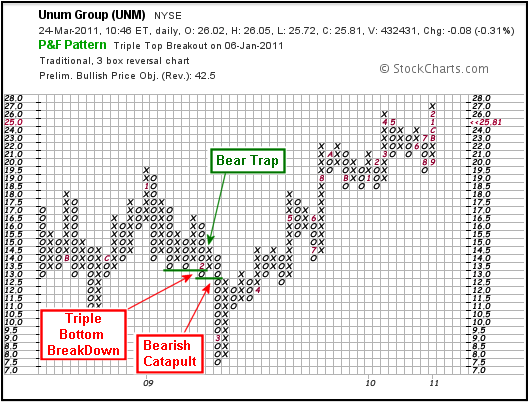

P F Bull Bear Traps Chartschool

Bull Traps Vs Bear Traps How To Trade With Them Phemex Academy

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)