are funeral expenses tax deductible in california

A death benefit is income of either the estate or the beneficiary who receives it. Furthermore the IRS typically qualifies tax deductions on medical expenses.

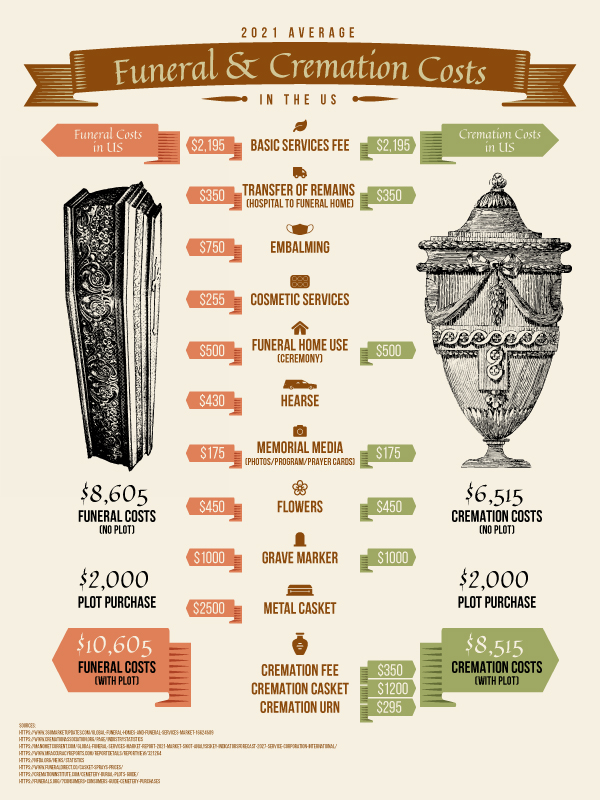

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes.

. The amount of the expenses claimed from the succession will be deducted if applicable from the death benefit paid by Retraite Québec provided the deceased gave. On home purchases up to 750000. Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible.

If the IRS requires the decedents estate to file an estate tax return the estates representative may be able to include funeral expenses as a deduction. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

While the IRS allows deductions for medical expenses funeral costs are not included. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the. Are funeral flowers tax deductible.

No Tax Knowledge Needed. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. Expenses that exceed 75 of your federal AGI.

Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable. Medical and dental expenses. According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return.

Deduction CA allowable amount Federal allowable amount. Medical expenses are a function of the deceased life and therefore deductible on the deceaseds final Form 1040 if allowed. While the IRS allows deductions for medical expenses funeral costs are not included.

In short these expenses are not eligible to be claimed on a 1040 tax form. Are funeral expenses deductible on 1041. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

On home purchases up to 1000000. If the beneficiary received. Who cannot deduct funeral expenses.

No you are not able to claim deductions for funeral expenses on Form 1041. This means that you cannot deduct the cost of a funeral from your individual tax returns. Funeral and final medical expenses are not deductible in Form 1041.

4 Tips About Funeral Expenses and Tax Deductions The following is an overview of the tax deduction rules for funeral expenses applicable to estates. Funeral expenses are part of the charges on the succession and can be claimed by the person who paid them. Its preparation is considered part of a funeral service and under state law funeral services arent taxable.

Funeral expenses are not tax deductible because they are not qualified medical expenses. If your loved one incurred fees from the hospital use of medical equipment lab services prescriptions medical supplies or routine exams you must itemize. Deducting funeral expenses as part of an estate.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. If the estates funds are used to pay the costs of the funeral those costs can be deducted on the estate. This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim.

However funeral expenses can qualify as tax deductions when the costs are paid out of a decedents estate. In other words funeral expenses are tax deductible if they are covered by an estate. Deductible medical expenses may include but are not limited to the following.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. The taxes are not deductible as an individual only as an estate. The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

That depends on who received the death benefit. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Qualified medical expenses include.

Are funeral expenses deductible on Form 1041. Job Expenses and Certain Miscellaneous Itemized Deductions. They are never deductible if they are paid by an individual taxpayer.

The funeral expenses are a function of the deceaseds taxable estate and are included in the estate tax return Form 706. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. These are considered to be personal.

Answer Simple Questions About Your Life And We Do The Rest. As with any other creditor of the succession supporting documents must be provided. Individual taxpayers cannot deduct funeral expenses on their tax return.

Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax returnAccording to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate. There are a few exceptions though including final medical expenses and costs incurred by the decedents estate.

The IRS deducts qualified medical expenses. Expenses of the funeral are payable from the estate even though the surviving spouse or another person is financially able or obligated to pay them. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling.

This cost is only tax-deductible when paid for by an estate. No never can funeral expenses be claimed on taxes as a deduction. One such deductible expense may be the expenses associated with the cost of the funeral.

Expenses that exceed 75 of your federal AGI. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. But extra copies of the death DVD that are given to.

Are Probate Fees And Funeral Expenses Tax Deductible Ez Probate

Funeral Taxes California Takes Its Cut From The Dead

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Are Medical Expenses Tax Deductible Community Tax

Are Medical Expenses Tax Deductible Community Tax

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Solved Which Of The Following Is A True Statement Multiple Chegg Com

Can I Deduct Funeral Expenses From My Income Taxes Debt Com

Are Funeral Expenses Tax Deductible Funeralocity

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

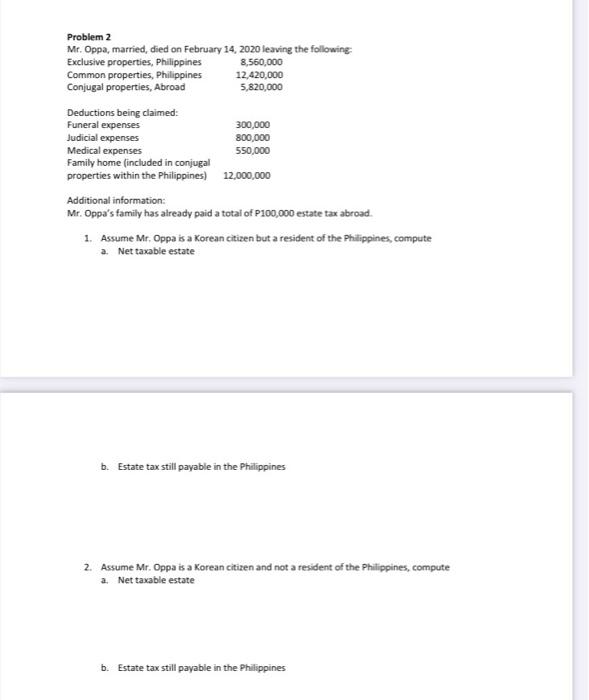

Problem 2 Mr Oppa Married Died On February 14 Chegg Com

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Table Of Contents California Society Of Cpas

How To Deduct Medical Expenses On Your Taxes Smartasset

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com